Market View

Neutral

Ideal Implied Volatility Condition

High Implied Volatility – Above 50%

Opening Setup

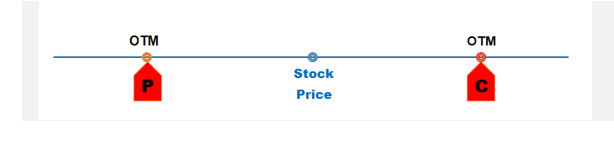

Ideal Trade Entry Delta

Option 1 - Short the 16 Delta puts and 16 delta calls (1SD) with Probability of profit of 84%

OR

Option 2 - Short the 30 Delta puts and 30 delta calls (1/2 SD) with Probability of profit of 70%

Net Debit/Credit

Net Credit

Optimal Time

Entering these trades 45-30 days until expiration is preferred and should allow you to collect enough premium

Volatility Impact

For Sellers – Everything else being equal:

Falling IV will generally help this position (will show MTM Profit) &

Rising IV will generally hurt this position (will show MTM Loss)

Other option is to scale into Implied Volatility Increase (i.e. now you can add one more strangle for the same strike or go further OTM and add a strangle)

Time Decay

Time decay or Theta works positively for us in this position. As net sellers we expect all or part of the trade to expire worthless at expiration

Risk Management

Being undefined risk strategies, we want to be a very cautious. As retail investors our capital allocation (towards initial margin requirement) towards undefined risk strategies should be very small % of our total capital.

Profit Target

If your position shows a profit close to 50% of the max credit received /potential gain, the best option would be to close the position.

Note: When you reach closer to expiry the gamma risk kicks in.

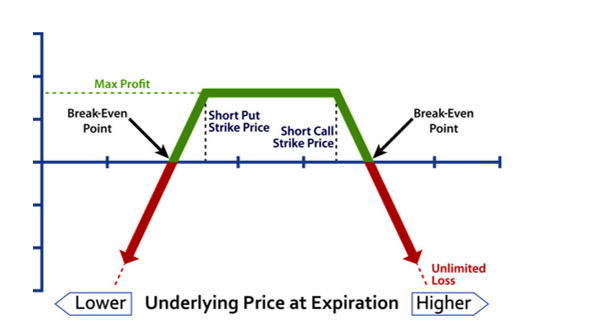

Breakeven Points(s) (BEP)

2 BEPs

-

Short call strike plus total credit.

-

Short put strike minus total credit.

Stop loss

Close your position at 2 time of total credit received.

Payoff Chart

Trade Management /Adjustments Options

No matter what level of Standard deviation we choose to trade our strangle we will be sometime be tested

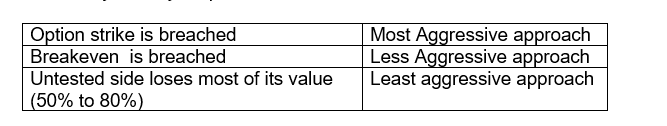

3 Trade Management options

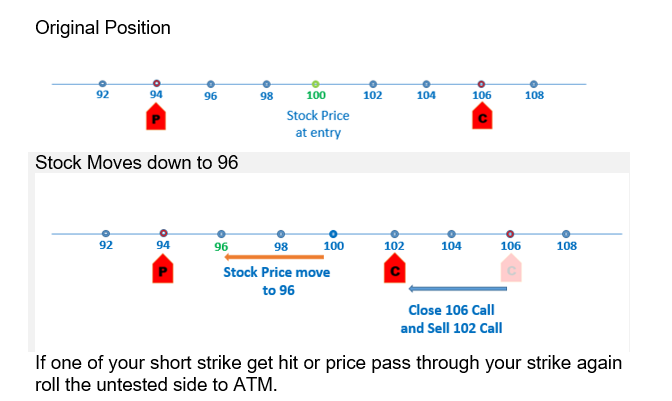

- Rolling Untested Option Closer:-

If the stock price rally - then roll the short put up closer to short call

If the stock price drops – then roll the short call down closer to the short put

Moving/rolling the untested side closer to stock price as to improve our BEP on the tested side. Instead of waiting for stock to come back to our BEP we move the BEP closer to stock price.

By this we are also reducing the gap of the strike where we are profitable and increase our max profit.

- Rolling Out in Time

Keeping same strike and rolling to next month (liquidity might be a problem)

There your risk of being ITM remain same, you just collect more premium and time.

- Combination of Both

If rolling up/down the untested side is not giving us the required credit, then we might consider the combination of both rolling up/down the untested side and rolling out to the next month.

When do you roll your position?

Note:

The probability of Touch (POT) is twice the probability of expiring ITM. So we need to give time to be right.

Being more aggressive might get you into a position where you have risk in both side and result being a straddle.

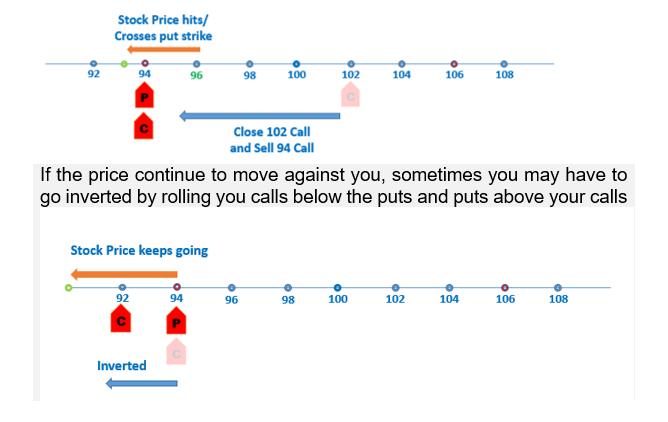

Example - Rolling the untested side

Rolling further when inverted will make sense only if there is enough extrinsic value in the price to gain from.

Other Points

Going Inverted limits profitability but allows your delta to stay more under control

When you have to roll out to the new expiration cycle, always uninvert your strangle which mean sell your strangle based on the actual price.

Inverted strangles have high risk of getting assigned because both the strike are deep in the money. Remember going inverted is just a defensive move.

You could add directional assumption to your stragles.

If u are slightly bullish – you may sell 30 delta Put and 16 delta Call

If u are slightly bearish – you may sell 30 delta Call and 16 delta Put.